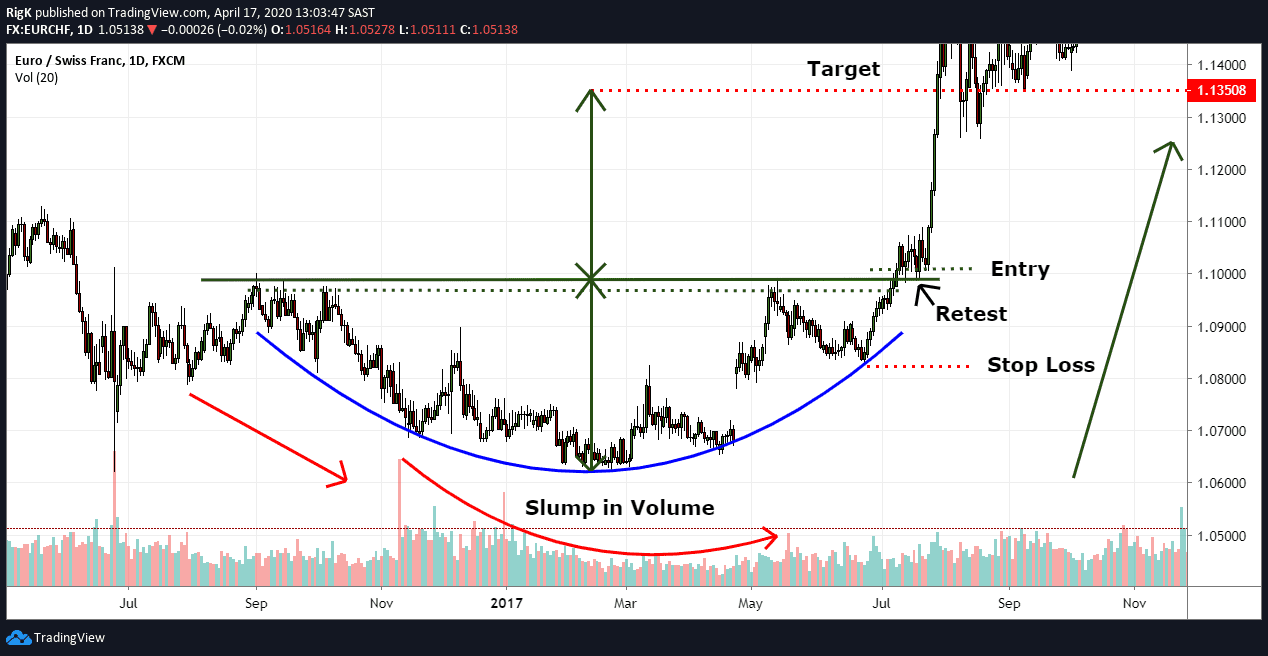

Ideally the low of a rounding. This pattern is considered complete once price finally breaks and closes above the neckline.

Rounding Bottom Reversal Chart Pattern Youtube

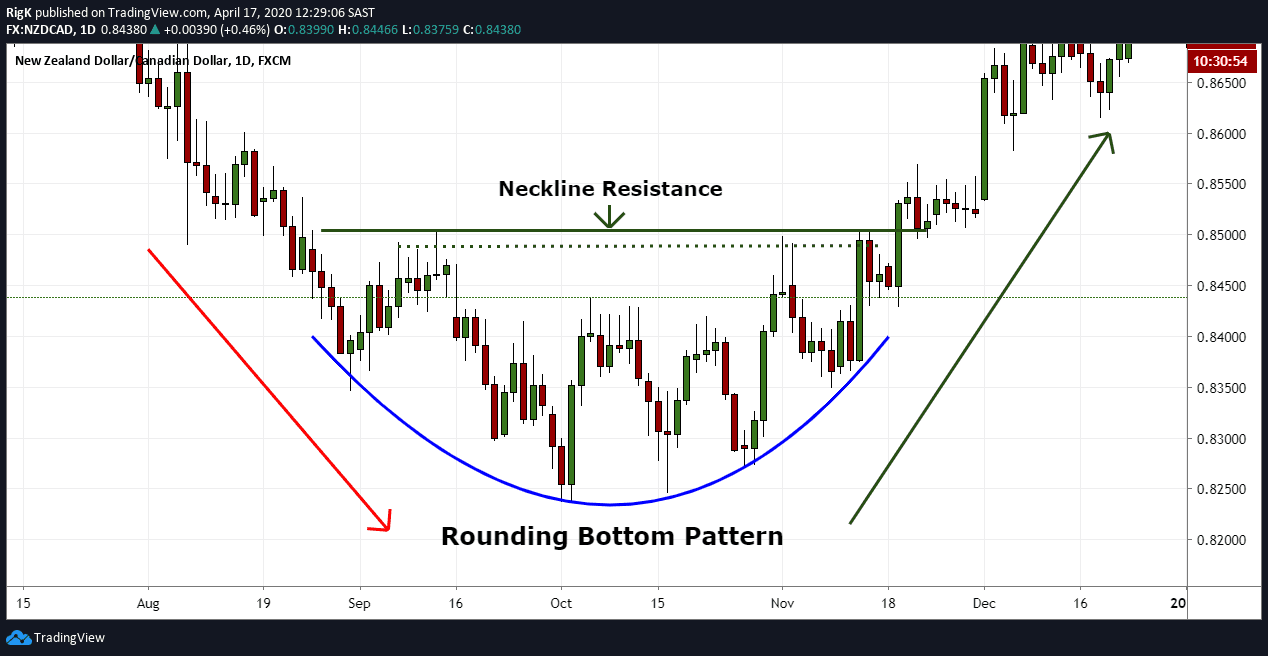

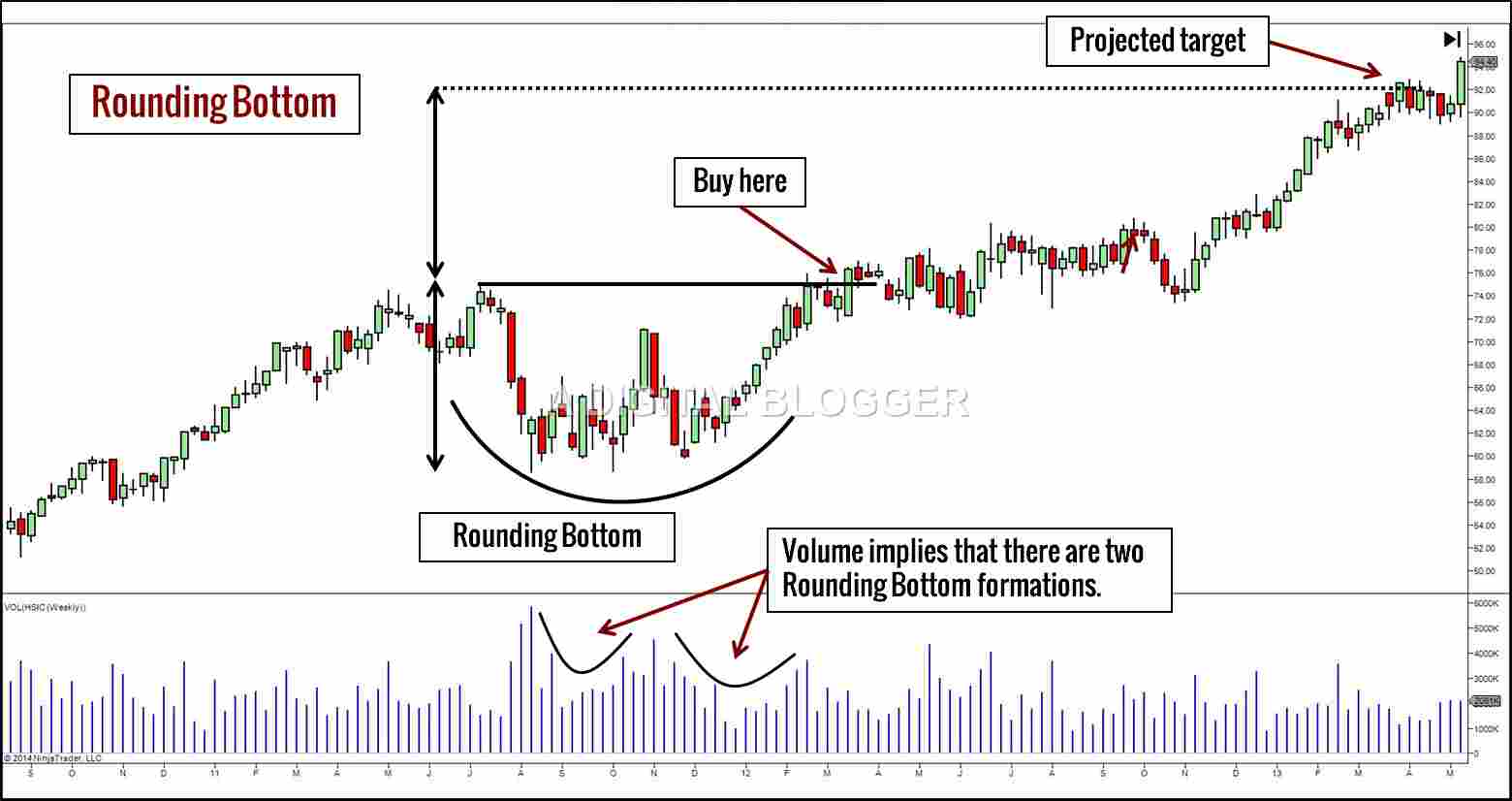

The weekly chart is most suited for the rounding bottom pattern as it has a longer consolidation period.

. To do this you need to. Measured move of 225 upon confirmation of breaking resistance sends it towards resistance of 13 which will also coincide with an attempted breakout from the macro downtrend line SNX has had since its ATH in February. Vibhor round bottom scanner2 - Round bottom - su - Round bottom scanner vibhor sir -.

NEW YORK -- One of my favorite chart patterns is called the rounded bottom breakout pattern. Confirmed Double Bottom stock chart pattern occurs when price bounces up for the second time from the support level and when it breaks above the shorter-term resistance see the chart. The Rounded Bottom Breakout or RBB for short is a very strong bullish reversal pattern that was discovered by Rick Saddler.

2 Rounded Bottom Neck Line. This pattern is found in downtrending stocks and is characterized by the rounded shape of the lows with no downside spikes. Vibhor - round bottom scanner2 - Vibhor - round bottom scanner2.

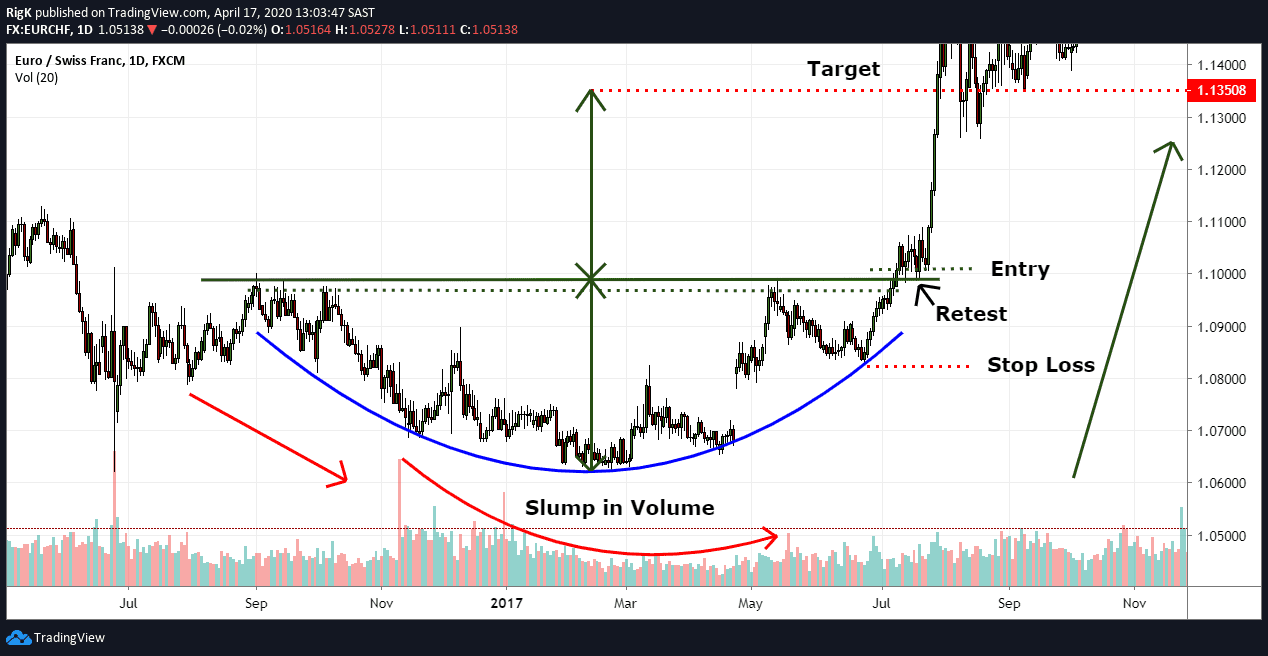

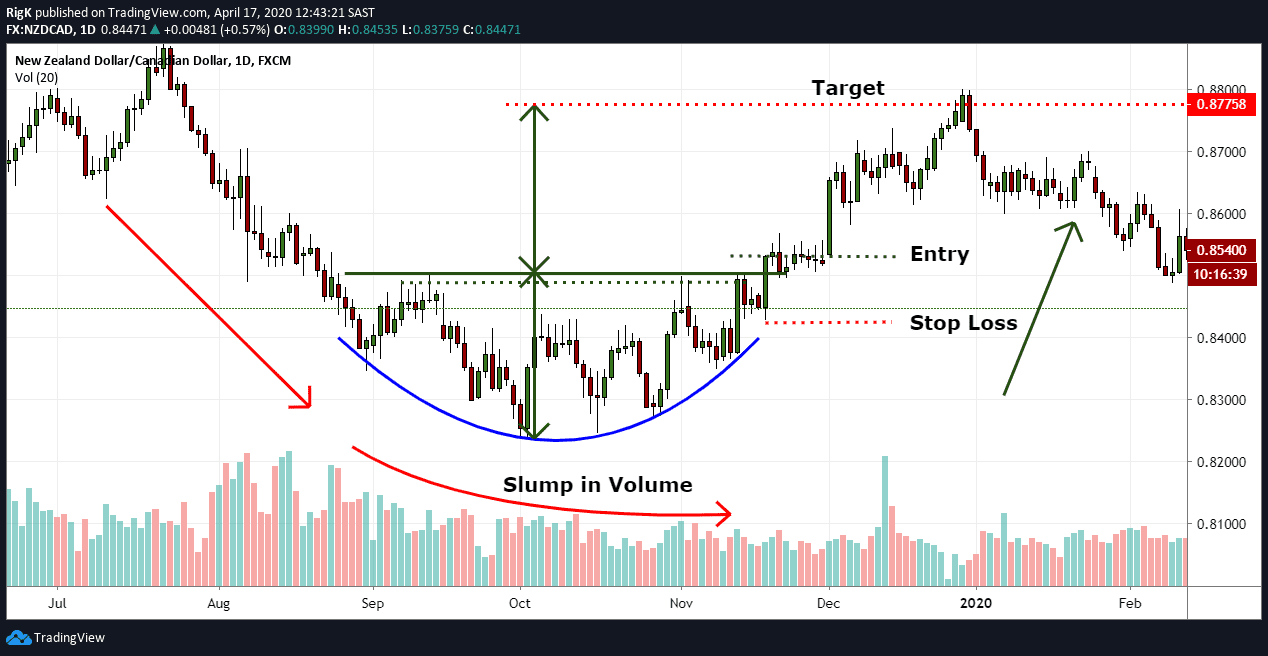

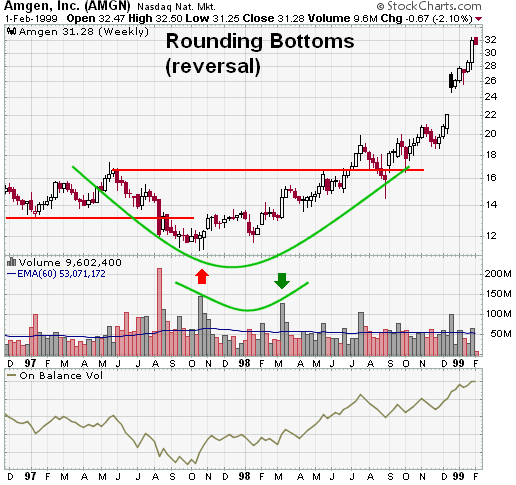

Rounded Bottom Reversal Pattern Fundamental Developments Could See The Bulls Back In This Microcap There are certain nutrients that are essential to live on Earth albeit a human or a tomato. By breaking above this shorter-term resistance we have the confirmation. The rounded bottom pattern appears as a clear U formation on the price chart and is also referred to as a saucer.

The rounding bottom pattern is used in technical analysis to signal the potential end of a downtrend and consists of a rounded bottom-like shape with a neckline resistance level where price failed to break through on numerous occasions. A rounding bottom is a chart pattern used in technical analysis that is identified by a series of price movements that graphically form the shape of a U. SNX forming a rounded bottom on the daily chart underneath resistance of 1070.

It resembles a clear U image. Other Indicators also indicate Upside Movement RSI MACD Recent Breakouts of Nifty Will also help push this stock price. In this episode of lets talk stocks we are going to take a look at the rounding bottom stock chart pattern.

Step by Step Guide for How to Trade the Rounding Bottom Pattern 1 Confirming the Rounded Bottom Figure. However it doesnt present a handle to signal the breakout. The first portion of the rounding bottom is the decline that leads to the low of the pattern.

A Rounded Bottom is considered a bullish signal indicating a possible reversal of the current downtrend to a new uptrend. In order to be a reversal pattern there must be a prior trend to reverse. Conversely the rounded bottom is a long-term bullish reversal pattern that signals the end of a downtrend and the possible start of an uptrend.

It signals the end of a downtrend and the possible start of an uptrend. Most of the time this is a reversal pattern ho. Rounded Bottoms are elongated and U-shaped and are sometimes referred to as rounding turns bowls or saucers.

The rounded bottom signals that the existing downtrend is about to finish and the possibility of an uptrend to commence. Instead the rounded bottom breakout is simply projected from the neckline resistance. Rounded bottom breakout pattern Rounded Bottom Breakout Pattern.

RBBs are formed by many candles over the course of weeks or months. The following Chart shows Rounded bottom for Indusind Bank also a Morning Start Candlestick pattern is formed on the weekly chart. Traders may sometimes call it the saucer bottom pattern.

It describes the drop of a stock or index. A rounded bottom or saucer pattern is not a common pattern but is highly reliable as a reversal pattern with bullish implications. Description The pattern is confirmed when the price breaks out above its moving average.

This means that the rounded bottom can indicate an opportunity to go long. After you identify the pattern you need to draw the neck line. Unlike sharp V-like price movements rounded tops and bottoms have a U-like appearance and occur over the.

Shorter-term resistance point 2 on the chart is the highest high between two bottoms between points 1 and 3. Rounding Bottom Prior Trend. NEW YORK TheStreet -- One of my favorite chart patterns is.

The rounded bottom are reversal patterns which identify the completion of the trend and indicate a possible reversal point on price chart. Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. The 4 Steps Required to Trade the Rounding Bottom Pattern Confirm The Rounded Bottom by finding a price decrease that slowly switches to a range followed by a price increase.

The pattern was introduced to me by candlestick analyst Rick Saddler who also coined the term rounded-bottom breakout Rick also defined the criteria for the breakout. This pattern is used to confirm trend reversals for long-term bearish trends. A Rounded Bottom is considered a bullish signal indicating a possible reversal of the current downtrend to a new uptrend.

You may see a bearish bias convert into a bullish bias over a long consolidation period. Initially A patterns move in one direction. The pattern is confirmed when the price breaks out above its moving average.

Similar to the cup and handle the rounded bottom pattern forms a U shape. Rounded Bottom Pattern. A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action.

Draw The Neckline by drawing a horizontal line across the top of the bearish and bullish sides of the rounding bottom. Rounding bottom pattern shows long-term reversal and is more suitable for weekly charts. The number of candles in the pattern will vary and can include many different shapes and color candles.

To confirm the pattern you need to find a price decrease which slowly. Spotting the rounded-bottom breakout chart pattern is easy and can yield sweet profits.

The Rounding Bottom Pattern Definition Examples 2022

The Rounding Bottom Pattern Definition Examples 2022

The Rounding Bottom Pattern Definition Examples 2022

Rounding Bottom Pattern Step By Step Guide To Use Rounding Bottom

:max_bytes(150000):strip_icc()/RoundingBottom2-0a1514186d454d4b9e4fba32aed39f24.png)

0 comments

Post a Comment